It’s pretty cool to see the start of a new industry, space tourism, literally and figuratively launch in front of our eyes this weekend.

Billionaire Richard Branson makes a statement as crew members Beth Moses and Sirisha Bandla float in zero gravity on board Virgin Galactic’s passenger rocket plane VSS Unity after reaching the edge of space above Spaceport America near Truth or Consequences, New Mexico, U.S. July 11, 2021 in a still image from video. Virgin Galactic/Handout via REUTERS. NO RESALES. NO ARCHIVES. THIS IMAGE HAS BEEN SUPPLIED BY A THIRD PARTY.

My hope is that you do so well with real estate (hopefully with a little help from us here at Real Report) that you too can afford one of those $200,000 tickets someday.

That…and hopefully those prices come back down to earth (see what I did there?).

This week: it’s time for our traditional deep dive into the monthly numbers. ?

Monthly Round-up June 2021

? Buyers rejoice.

We just had the largest single-week increase (264) in active inventory since we’ve been tracking the numbers (Nov. 2019)

| July 2-8 | Prev 4 Week Avg. | % Change | June 25-July 1 | |

|---|---|---|---|---|

| New Listings | 826 | 800 | 3.31% | 797 |

| New Pending Sales | 704 | 890 | -20.85% | 926 |

| New Sales | 542 | 738 | -26.53% | 871 |

| Active Inventory | 3,483 | 3,221 | 8.13% | 3,219 |

| 30 Year Fixed Mortgage | 2.90% | 2.97% | -2.44% | 2.98% |

And there’s another reason for buyers to rejoice. Mortgage rates actually fell (and pretty substantially) last week to 2.90% driven primarily by a drop in the 10-year treasury.

There’s A LOT that goes into this move lower – honestly, it even makes my head spin – so for the ambitious learners out there that want to dive in further, read here and here.

The stars are aligning for Q4 to be potentially a SOLID environment for buyers if rates can stay low like this.

| Detached (6-2021) | Detached (6-2020) | % Change | Attached (6-2021) | Attached (6-2020) | % Change | |

|---|---|---|---|---|---|---|

| New Listings | 2,648 | 2,681 | -1.23% | 1,465 | 1,489 | -1.61% |

| New Pending | 2,461 | 2,417 | 1.82% | 1,431 | 1,220 | 17.30% |

| New Sales | 2,474 | 2,052 | 20.57% | 1,300 | 1,041 | 24.88% |

| Med. Price | $879,000 | $680,000 | 29.26% | $553,500 | $453,000 | 22.19% |

| % Orig List Price | 105% | 98.6% | 6.5% | 103.6% | 98.6% | 5.1% |

| Inventory | 1,947 | 3,754 | -48.14% | 1,004 | 2,083 | -51.8% |

| Mo. Supply | 0.9 | 2 | -55.0% | 0.8 | 2.2 | -63.64% |

| Avg DOM | 17 | 30 | -43.33% | 18 | 32 | -43.75% |

| Affordability | 43 | 56 | -23.21% | 68 | 84 | -19.05% |

| 30 Yr Fixed | 2.98% | 3.16% | -5.7% |

While still on ???? , June’s data is showing the signs of what we’ve been feeling over the last 8 weeks – the market is starting to cool off.

Detached median price rose by $14,000 month over month (impressive by normal standards), compared to $25,000 in May and $30,000 in April.

While detached homes appear to be approaching a pricing pain threshold for buyers, it seems some might be redirecting their focus to the more affordable attached home space.

Attached median price rose $13,500 month over month. That represents a 2.5% month-over-month appreciation rate compared to 1.62% for detached homes.

Similarly, the available inventory of attached homes went down month-over-month while the detached home inventory increased.

It will be interesting to see if this is just a monthly anomaly or a trend that sticks for a while.

Fun, mind-blowing factoid for you – total US homeowner tappable home equity grew by over $800 BILLION in the first quarter of 2021. That’s a 23% year-over-year gain.

That’s A LOT of spending power.

Do you think this might have something to do with the inflation we see in products and services outside of the CORE prices the Fed pays attention to in their metric? ?

When people tap home equity they tend to spend it on luxuries, not necessities. Now you know why that RV you want to buy is so much more expensive now.

In The News

- All this appreciation means bucko bucks in tax dollars to San Diego.

- Something to consider: less water and more housing don’t necessarily mix.

- The COVID Delta variant that’s ravaging the world is rearing its ugly head in San Diego.

The Week Ahead

- The June Consumer Price Index (aka inflation data) is released later today. The market has shrugged off the last two months of higher than expected numbers. Will that continue? Who knows! In a normal market, higher inflation would add pressure to move mortgage rates higher. With all this government intervention pulling strings behind the scenes, the market is definitely not acting normal.

We’re still setting records across the board, but the pace is starting to slow.

This is GOOD and HEALTHY…not a sign of pending doom as some would have you believe.

Keep reading below as I (try to) apply what I’m seeing in the data and news to the future direction of the real estate market here in San Diego.

Looking Ahead

The San Diego real estate market is influenced primarily by three variables right now:

- Housing supply

- Mortgage rates

- Local job market (employment and wages)

Every month I touch on each one to see how we’re doing using labels. GREEN means upward pressure on prices, ORANGE means even pressure, and RED means downward pressure.

Housing Supply – GREEN

IMO, the weekly data is a better tool to use to spot an early shift in the supply/demand dynamic.

Right now, the pace of new supply is outpacing the pace of demand. This isn’t a short-term blip on the radar – it’s a 10-week trend.

This is good news for a healthy market. That said, we’ve got a ways to go, meaning a lot more supply is needed to get there.

Last time we saw a dip in home values (outside of the shutdown last year) was 2018 when the inventory level peaked just above 15,000. We’re still sitting below 3,500. Seeing those numbers side by side really puts the current market in perspective.

Mortgage Rates – GREEN

This recent drop in rates is surprising. It seems that not even the most seasoned experts are able to make reliable predictions. I know I’m done trying ?

Inflation is definitely a short-term concern, but apparently, long-term growth is a concern also among the big bond market players. Those two fears are battling each other right now which is why we find ourselves stuck in this narrow range of around 3%.

Which side is going to win out? Only time will tell. As long as the average 30-year rate is below 3.25%, I’m keeping this variable in the GREEN.

Jobs – GREEN

I’m bullish on the San Diego economy. The more I dive in the more I like what I see.

Big tech and new tech companies are coming to play and bringing higher-paying jobs with them. The life science industry is only growing in need and scope, and San Diego is ground zero. And the hospitality and military industries provide a helluva foundation to support all of it.

Conclusion

Over the next 3-6 months:

Home prices will keep increasing but the rate at which that happens will continue to slow.

Over the next 6-18 months:

Assuming no new variable or government intervention is thrown into the equation, I wholeheartedly expect prices to hit some sort of ceiling, marketing times to increase, and prices to bounce lower for a period until we find equilibrium.

That doesn’t mean a crash, it just means a slight pullback that is normal when the tides of the market shift from sellers to buyers (just like any other asset class).

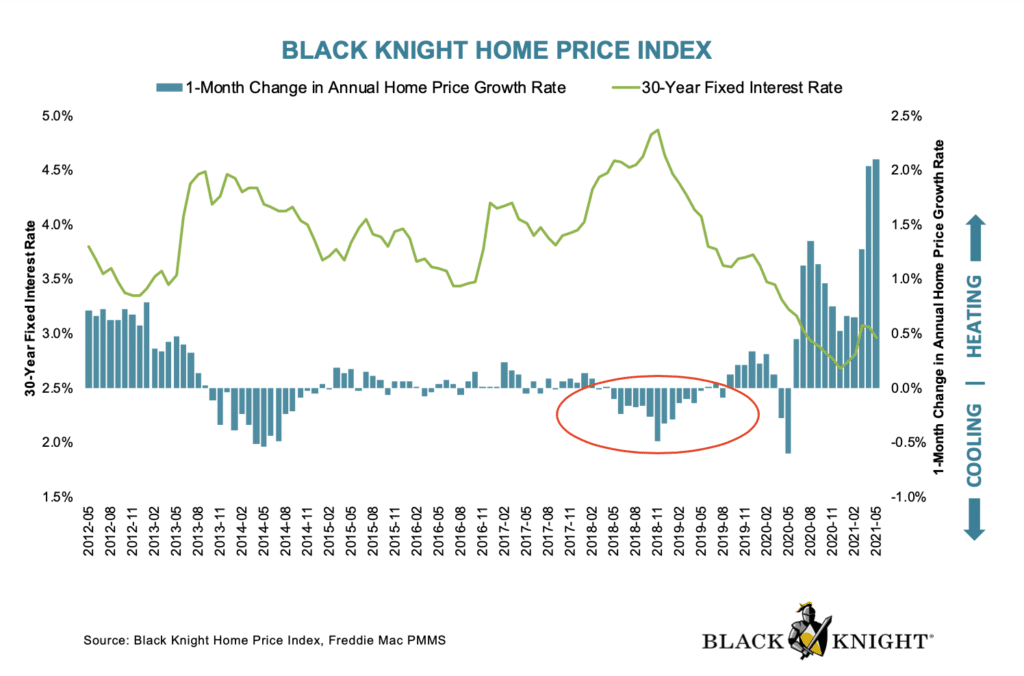

This graph from Black Knight does a good job showcasing what’s typical. The red circle is my addition.

This period in 2018 wasn’t a crash. It was a softening and pullback driven by a slowing of demand as interest rates rose.

As I mentioned above, San Diego inventory of available homes for sale during that period climbed to over 15,000 – we’re still less than 1/4 of that so we have a ways to go.

That said, my hunch tells me with prices as high as they are, there are fewer buyers that qualify to purchase now compared to then, so I think we’ll start to feel the pullback well before we get to 15,000 inventory.

I’ll be watching the data closely. I’m already penciling in longer hold times for properties we are buying now. I’m also expecting to factor in minimal price depreciation into our proformas if inventory levels creep above 7,000 and mortgage rates start going up again.

Word of caution to buyers out there waiting for prices to pull back. Don’t.

If that happens, it’s only because interest rates increased. If interest rates increase it’s likely your monthly mortgage payment will be higher even after a 5%-10% price correction in prices. Payment matters more than price.

Disclosure: My niche in the residential space (value-add short-term flips) is susceptible to these short-term changes. I have to make sure we start adjusting for this early. Consequently, I may be more conservative than others.

I can live with that. I’d rather be too early than too late.